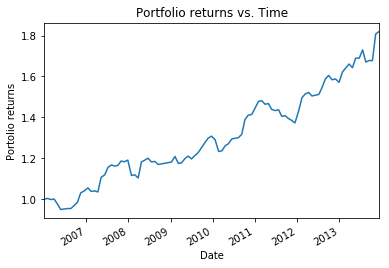

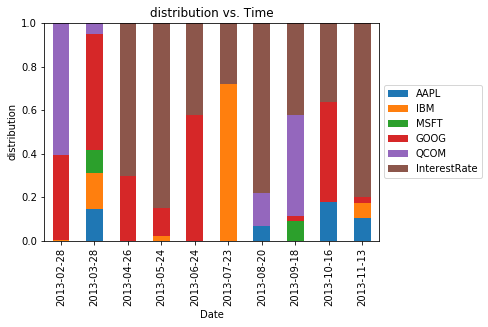

Modern portfolio theory was pioneered by Harry Markowitz in 1952 and led to him being awarded the Nobel Prize in Economics in 1990. The original essay on portfolio selection has since inspired a multitude of researchers and analysts to develop theories on financial modelling and risk management. Seeking similar inspiration, I studied the classical portfolio optimization technique introduced by Markowitz and applied it to real world data.

I used Pandas and CVX (for Matlab and Python) to build data pipelines, apply optimization algorithms and run backtests on real world financial data. I published my experiments in a technical report as the semester project for the Convex Optimization course at EPFL.

Despite how simple the project was, I used it as a reason to explore some interesting topics on financial modelling and quantitative trading in addition to understanding the optimization techniques involved. I also learnt a ton about covarience matrix construction for financial assets and the computation of the nearest positive semidefinite matrix.